The central goal of this Lecture 10A on “Real Statistics: An Islamic Approach”, is to establish that standard methodologies currently in use in statistics/econometrics, particularly regression, are built on the wrong foundations, and incapable of generating knowledge. To understand WHY this is so, it is necessary to study the flawed philosophy of science used to build these foundations.

While the car is functioning well, one does not usually open up the engine. But when the car breaks down, it becomes necessary to open it up to see what is wrong. This is the situation today, as the failure of econometric models manifested itself in the global financial crisis, as well as many other occasions. The tragedy is that these same failed models continue to be used today; no serious alternatives have been developed. The reason for this is that the methodology used to develop these models is inherently flawed, and incapable of producing knowledge. It is necessary to understand the engine – the philosophy of science underlying statistics and econometrics – to see why this is so. A capsule summary outline of why it is necessary to discuss philosophy of science is given below:

- Science was imported into Europe from Al-Andalus (Islamic Spain) via the Reconquest in 1492, which made available to the West, millions of books in the libraries of the Islamic Civilization. See “Is Science Western in Origin?”.

- These books ended the dark ages of Europe and led to the Enlightenment.

- Over the next two centuries, there was a tremendous battle between “Science” (Islamic philosophies, science, and other types of knowledge) and “Religion” or Christianity.

- This battle was won by science, and the “Philosophy of Science” emerged as separate discipline, distinct from science itself. The goal of this philosophy was the prove that science was a source of certain knowledge, and it was the ONLY such source – in particular, all religious knowledge was merely ignorance and superstition.

5.Because of these ideological blinders, the philosophy of science set for itself an impossible task. Therefore, it was not able to make any progress in understanding the true nature of science. To this day, there is massive confusion about what science is, and how it works (for example, see Chalmers “What is this thing called science?”).

5.Mistaken “positivist” understandings of science were used to build the foundations of economics, statistics, and econometrics. Today, it is an urgent need to recognize these flawed foundations, and rebuild these disciplines (and all of the social sciences) on new foundations.

Mathematics, especially the geometry of Euclid, was the first discipline of knowledge established by Greek Philosophers. This was based on taking intuitive certainties as axioms, and then deducing more complex truths by using logical deductions. This is called the axiomatic-deductive methodology.

Unfortunately, this methodology does not work well in this case. For centuries, philosophers were divided on the issue of whether light emanates from eyes to strike the object, or whether light comes from the object to the eye. There were axiomatic-deductive demonstrations for both positions

Ibnul Haytham was the first to use empirical methods to resolve this controversy, laying the basis for the scientific method. It is worth discussing his contribution in detail, because the concept of a “MODEL” emerges from his study. This concept is central to understanding the problems with current foundations of the social sciences. See “Models & Reality” for further discussion on this point.

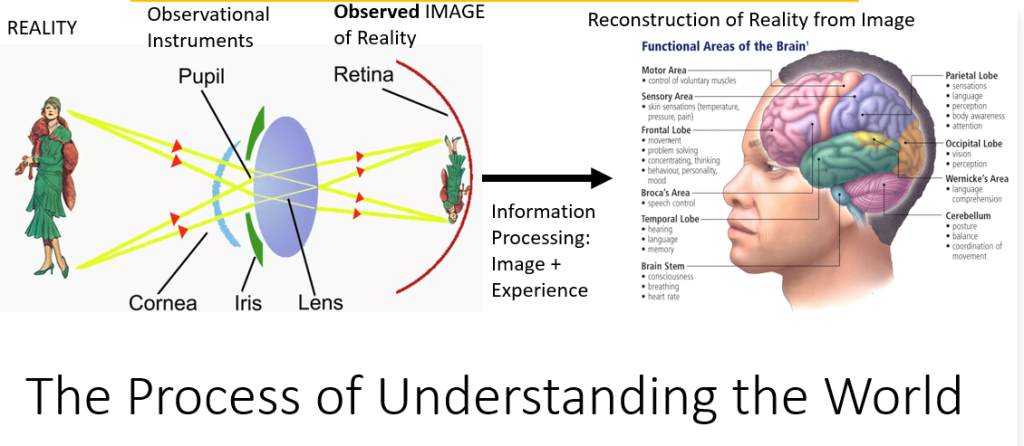

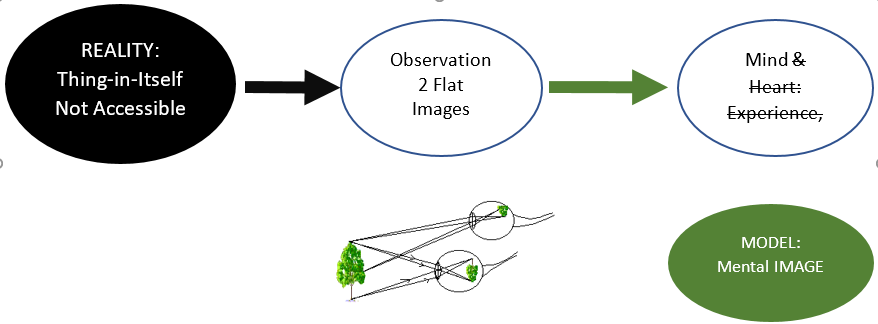

Light from the object (woman) travels in straight lines, is focused onto our retina within our eyes. An inverted image of the woman is formed in the two retinas. Our MIND analyzes the two images and RECONSTRUCTS the external object. What we see directly are the images on the retina, and the picture of reality is created by the MIND based on calculations and past experience in interpretation of such images. Thus we see with our minds, not with our eyes. A schematic sketch of how we see is given in the diagram below:

It is crucial to understand that we do NOT directly see the external world. Our mind re-creates a picture of external reality based on clues furnished by the images on our retina, which actually give us an inverted picture of reality. An amazing experiment was performed to show how we see with our minds.

A student was fitted with inverting glasses, which make the world appear upside down, and told to keep them on constantly. After a few days of dizziness and disorientation, he learned to see through these glasses without difficulty. THEN the world appeared upside down when the glasses were removed. The mind was able to re-interpret the inverted image and fix it, to enable the person to see the world as it is.

A realist philosophy of science asks us to build models which are closely matched to hidden structures of reality which generate the observations that we can see. However, a nominalist (empiricist, positivist) philosophy is concerned only with building models which provide a good match to the observations, without any concern about reality. The shift from realism to nominalism – for reasons far more complex than Kant’s philosophy discussed above – had disastrous consequences, especially for the social sciences. Modern social sciences were create in the early 20th century, based on conscious adoption and imitation of methods of the physical sciences. However, these methods were misunderstood; it was assumed that “science” only deals with observables, and not with unobservables. This has led to deeply flawed foundations for social science. We briefly explain the implications for economics and econometrics.

Impact of Positivist Methodology on Economics & Econometrics

The most famous and widely read methodological essay in economics is Friedman’s “The Methodology of Positive Economics”. In this essay, Friedman argues that good models have “bad” (false) assumptions – in fact, “The more wildly inaccurate the assumptions, the better the model”. The meaning here is that if a drastic over-simplification of a complex reality gives good results in terms of providing a good fit to observations, this is the sign of a good model. However, this methodological principle gives us a license to make any assumption we like, as long is it produces a good fit to the data. See Friedman’s Methodology: A Stake through the Heart of Reason. This is what results in terrible models in economics, statistics, and econometrics, as we briefly illustrate.

Top ranked economist Lucas writes that “Unlike anthropologists, however, economists simply invent the primitive societies we study.” The “invented society” is populated by “homo economicus” a robot with behavior predictable by mathematical laws. In principle, economists are supposed to check if the results from their artificial models match observed reality. In practice, they rarely bother to do so. See my paper on “Models and Reality: How Models divorced from Reality became epistemologically acceptable”, for details.

In statistics, we start with data on a variable X, observed across time to get observations X(1), X(2), …, X(T). We assume, without any justification, that all of these observations are random samples from a common infinite population. If the data appears to “fit” our assumption, this by itself justifies the assumption, without any need of checking the assumption against external reality. We have argued in this course that this leads to defective inference, and we should approach data analysis without making such unjustifiable assumptions, in accordance with a realist philosophy of science.

- JM Keynes: “professional economists … were apparently unmoved by the lack of correspondence between the results of their theory and the facts of observation”

- Solow: To discuss economic theory seriously with Lucas & Sargent is like discussing cavalry tactics at Austerlitz with a madman who believes himself to be Napoleon Bonaparte. Instead, I prefer to just laugh!

- Romer: modern macro theories give wildly incorrect predictions and are based on fundamentally flawed doctrines, beyond the possibility of repair.

LINKS to related materials: Flawed foundations of social sciences: The Emergence of Logical Positivism (shortlink: http://bit.do/azelp ) Sources for above quotes, and additional Quotes Critical of Economics – http://bit.do/azquo More details about above arguments How Economic Models became Substitutes for Reality. https://ssrn.com/abstract=3591782